A report released today by the British Retail Consortium (BRC) shows that cash use in payment transactions is still the predominant payment choice but is one that is gradually declining.

The BRCs Retail Payments Survey 2013 reports that cash has reduced in value, number of transactions and the average transaction value.

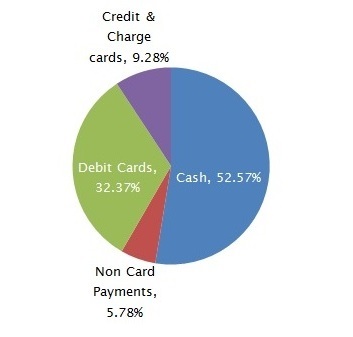

Courtesy of the British Retail Consortium, Retail Payments Survey 2013

When comparing to the 2012 figures, cash has dropped 4.5% when measured as a percentage of sales turnover and 3.3% as a percentage of sales transactions.

However, as can be seen from the above chart, cash is still the majority choice of payment and accounted for 52.57% of all transactions in 2013 (down from 54.35% in 2012).

In contrast, debit cards are becoming more popular and now account for 50% of sales turnover and 32% of sales transactions – both of which have increased from 2012. A contributing factor for this has been the increase of contactless cards provided by banks which permit payments below £20, helping to replace cash used in small transactions.

Another contributing factor reported is the use of self-service facilities where the use of card payments outweigh cash, presumably due to it being an easier payment method for users compared to cash for such transactions.

Read the full report here.

Source: British Retail Consortium